Decentralized Finance, or DeFi, is a transformative force that’s reshaping the landscape of the financial world. By leveraging blockchain technology and cryptocurrencies, DeFi is creating a new, open financial system that’s more transparent, accessible, and efficient than traditional financial systems. But its impact doesn’t stop there. DeFi is also revolutionizing the gaming industry, particularly in the realm of play-to-earn games.

The Rise of DeFi

The DeFi movement has been gaining momentum at an unprecedented rate. According to DeFi Pulse, the total value locked in DeFi protocols has skyrocketed from less than $1 billion in early 2019 to over $100 billion in 2023. This meteoric rise is a testament to the growing acceptance of cryptocurrencies, the evolution of blockchain platforms, and the global demand for more equitable financial systems.

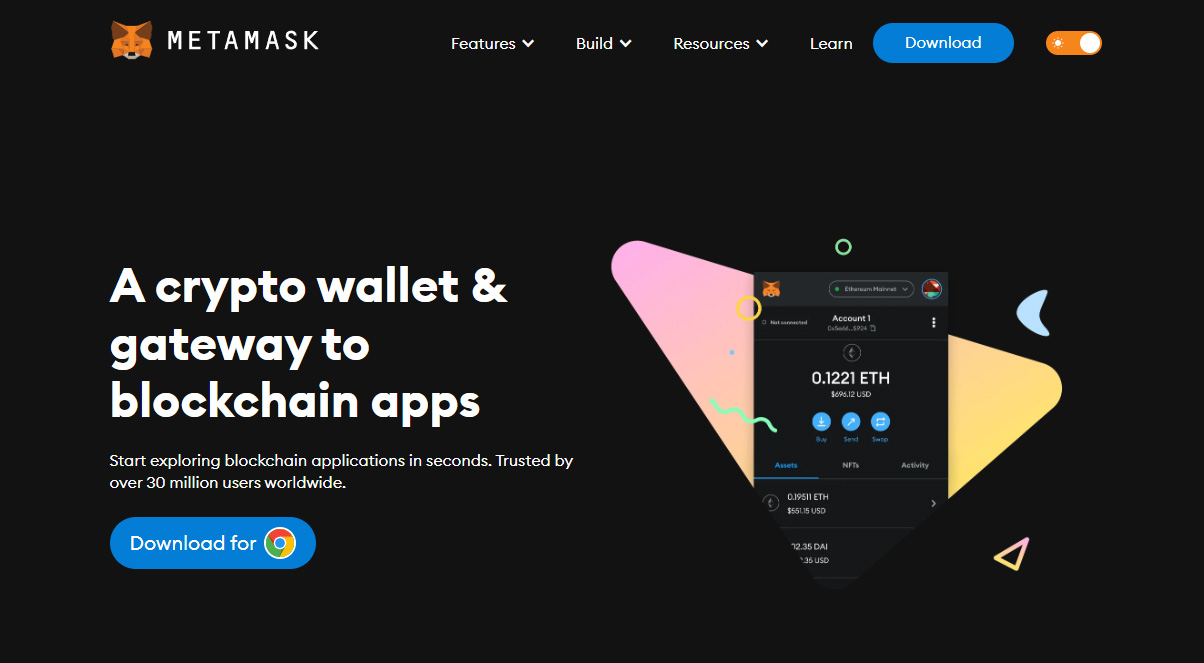

Several breakthroughs in technology and innovative companies have led the way in providing new DeFi services safely and efficiently. For instance, Ethereum, with its smart contract functionality, has been a significant enabler of DeFi. It has allowed the creation of decentralized applications (dApps) that provide financial services without the need for a centralized authority.

Companies like MakerDAO, Compound, and Uniswap have been at the forefront of the DeFi revolution. MakerDAO, with its stablecoin DAI, has provided a stable medium of exchange in the often volatile crypto market. Compound has allowed users to earn interest on their crypto assets, while Uniswap has enabled decentralized trading of cryptocurrencies.

These services have not only provided more financial tools for crypto users but have also attracted new users to the crypto space, further fueling the growth of DeFi. The success of these platforms has shown that DeFi can provide real-world financial solutions, which has led to more innovation and investment in the space.

Moreover, the rise of DeFi has also contributed to the growth of the overall crypto market. As more people use DeFi services, the demand for cryptocurrencies has increased, leading to a rise in the value of many cryptocurrencies. This has created a positive feedback loop, where the growth of DeFi fuels the growth of the crypto market, which in turn fuels more growth in DeFi.

How DeFi Works

Decentralized Finance, or DeFi, is a term that refers to the use of blockchain, digital currencies, and smart contracts to replicate and improve upon traditional financial systems such as loans and insurance. It’s called “decentralized” because it doesn’t rely on centralized intermediaries like banks or insurance companies. Instead, it operates on a peer-to-peer model, facilitated by blockchain technology.

One of the key components of DeFi is the smart contract. A smart contract is a self-executing contract with the terms of the agreement directly written into lines of code. They are stored on the blockchain and automatically execute when the conditions in the agreement are met. This eliminates the need for a middleman and allows for greater transparency, security, and efficiency.

For example, let’s consider a DeFi lending platform. In a traditional lending scenario, you would need to go through a bank or a lending institution, who would assess your creditworthiness, decide on the terms of the loan, and facilitate the loan process. In a DeFi lending platform, all of these functions are automated through smart contracts. You can lock up your crypto assets as collateral and receive a loan in a stablecoin, all without needing to go through a credit check. The terms of the loan, including the interest rate and the collateralization ratio, are pre-set in the smart contract.

Aave and Compound are two examples of DeFi lending platforms that have pioneered this model. They allow users to lend and borrow a variety of cryptocurrencies directly on their platforms. The interest rates are determined algorithmically based on supply and demand, and all transactions are secured by the blockchain.

Another breakthrough in DeFi technology is the concept of decentralized exchanges (DEXs). Unlike traditional exchanges, which require you to deposit your funds into the exchange’s custody, DEXs allow you to maintain control of your funds until the trade is executed. This significantly reduces the risk of loss due to exchange hacks. Uniswap and SushiSwap are examples of DEXs that have gained popularity due to their ease of use and non-custodial nature.

These innovations in DeFi have led to a significant growth in the sector. According to DeFi Pulse, the total value locked in DeFi has grown from less than $1 billion in early 2020 to over $40 billion in early 2021. This growth has been fueled by the increased accessibility and efficiency of financial services, as well as the potential for high returns.

However, it’s important to note that DeFi also comes with its own set of risks. Smart contracts, while secure, are only as good as the code they are written in, and bugs in the code can lead to significant losses. Furthermore, the volatility of the crypto market can lead to liquidations if the value of the collateral falls too quickly. Therefore, while DeFi has the potential to revolutionize the financial industry, it’s important for users to understand the risks and do their own research before participating.

In conclusion, DeFi works by utilizing blockchain technology and smart contracts to create a decentralized financial system. It has the potential to increase efficiency, reduce costs, and improve accessibility in the financial sector. However, like any emerging technology, it also comes with its own set of challenges and risks. As the technology matures and more people become aware of its benefits, we can expect to see continued growth and innovation in the DeFi sector.

DeFi and Play-to-Earn Gaming

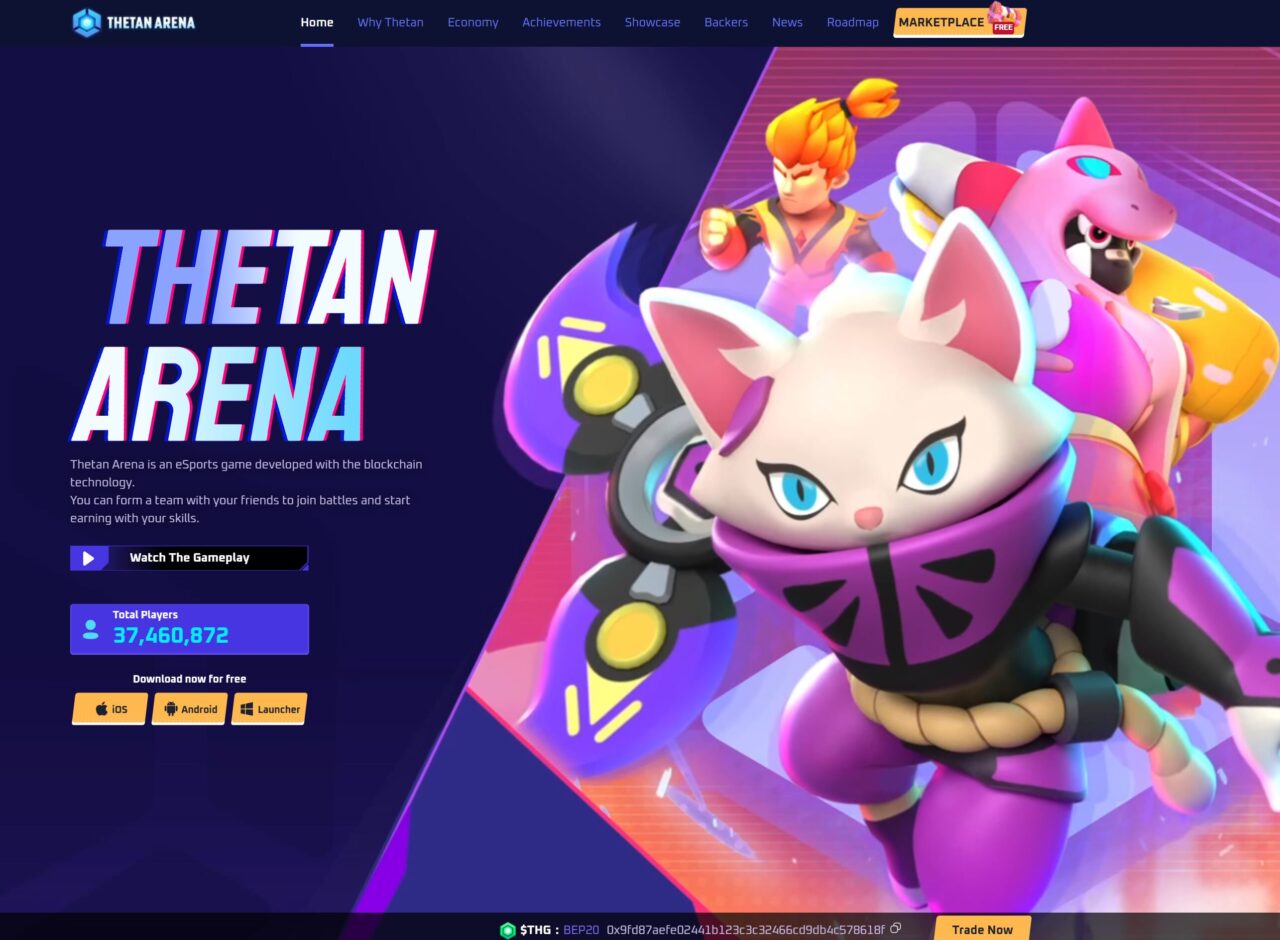

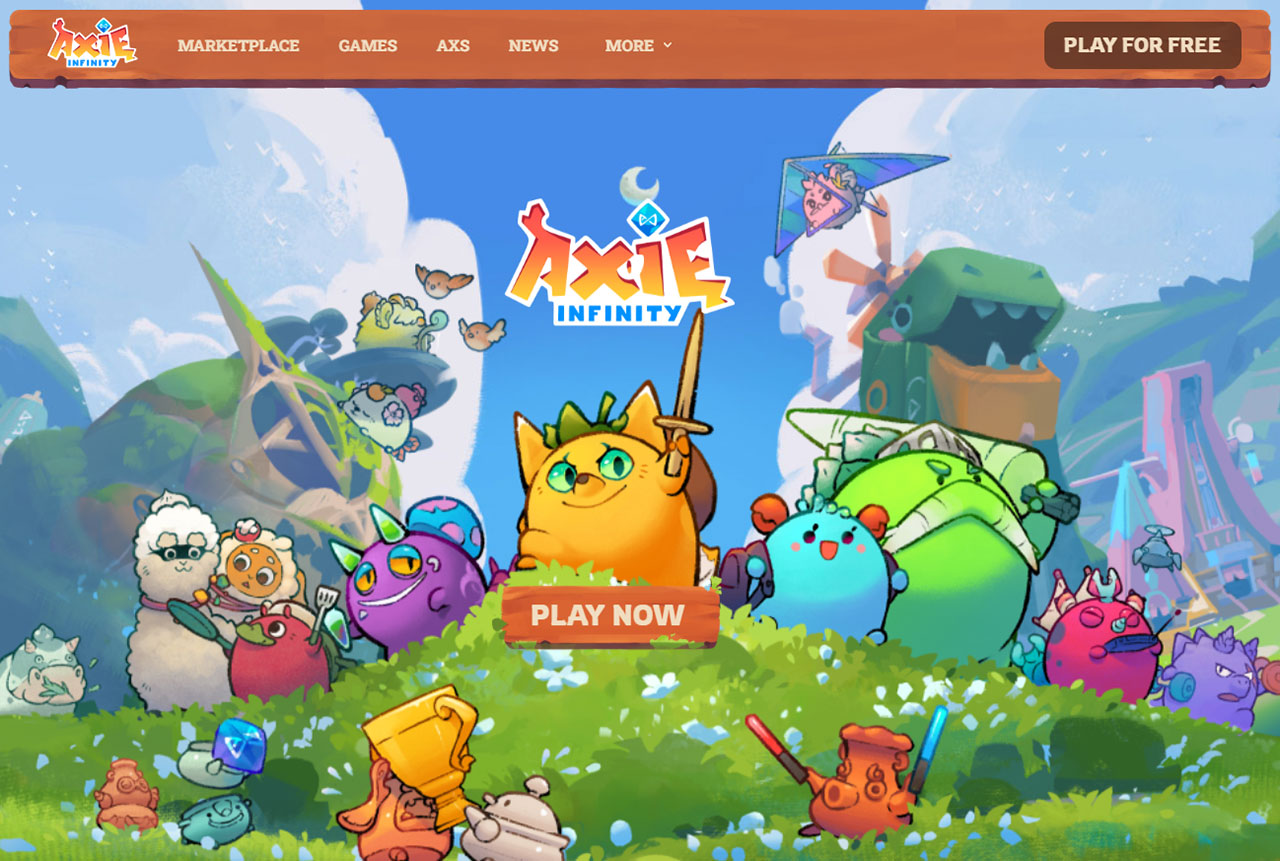

DeFi is making a significant impact on the gaming industry, particularly in the play-to-earn sector. Play-to-earn games, such as Axie Infinity and CryptoBlades, are leveraging DeFi to create in-game economies where players can earn real-world value.

In these games, players can earn tokens through gameplay, which can then be traded on DeFi platforms for other cryptocurrencies or even fiat currency. This not only adds a new level of engagement and incentive to these games but also opens up new revenue streams for players, particularly in regions where traditional banking systems are inaccessible or inefficient.

The integration of DeFi in play-to-earn games is facilitated by the use of blockchain technology, which ensures the security and transparency of transactions. When a player earns tokens in a game, the transaction is recorded on the blockchain, providing a transparent and immutable record. This ensures that players are rewarded fairly for their efforts and that the tokens they earn are securely stored in their digital wallets.

Furthermore, DeFi allows players to maximize their earnings from play-to-earn games. For example, players can lend their in-game assets or tokens to other players in exchange for interest, or they can stake their tokens in liquidity pools to earn rewards. This creates a dynamic in-game economy where players can not only earn tokens through gameplay but also grow their earnings through DeFi strategies.

The integration of DeFi in play-to-earn games also contributes to the sustainability of the game’s economy. In traditional games, the value of in-game assets often depreciates over time as more assets are introduced into the game. However, in play-to-earn games integrated with DeFi, the value of in-game assets can appreciate over time as players use DeFi strategies to create demand for these assets.

In the future, we can expect to see more play-to-earn games integrating DeFi, creating more opportunities for players to earn and grow their wealth. This is a testament to the transformative potential of DeFi and its role in shaping the future of the gaming industry.

DeFi: A Positive Disruption to Traditional Banking

The emergence of DeFi is a positive disruption to the traditional banking system. By offering a decentralized alternative to traditional financial services, DeFi is challenging the status quo and encouraging the banking industry to innovate and adapt. Banks and other financial institutions are now exploring blockchain technology and considering how they can leverage it to improve their services and meet the evolving needs of their customers.

Regulatory Response to DeFi

The rapid growth of DeFi has caught the attention of regulators worldwide. The U.S. Securities and Exchange Commission (SEC) and other government bodies are closely monitoring the DeFi space. They are working to understand and regulate the DeFi space to protect investors and maintain market integrity. However, the decentralized and global nature of DeFi presents significant regulatory challenges.

While the SEC has expressed concerns about the lack of transparency in DeFi and the potential for market manipulation, it’s important to note that the DeFi community is actively working on solutions to these issues. The community is developing new protocols and standards to increase transparency and reduce the risk of manipulation.

The Future of DeFi

The future of DeFi is incredibly exciting, with new projects and innovations on the horizon. One of the exciting developments is the integration of DeFi with real-world assets. Projects like Centrifuge are working on bringing real-world assets to DeFi, opening up a world of possibilities for lending, borrowing, and investing.

Another area of growth is the development of Layer 2 solutions and other scalability solutions for Ethereum. As the majority of DeFi applications are built on Ethereum, the network’s scalability issues have been a significant bottleneck. However, with the development of Layer 2 solutions like Optimism and zkSync, and the upcoming Ethereum 2.0 upgrade, we can expect to see a significant improvement in the network’s scalability and efficiency, which will further boost the growth of DeFi.

In the gaming industry, we are seeing the rise of play-to-earn games that integrate DeFi elements, creating new opportunities for players to earn real-world value. Games like Axie Infinity and The Sandbox are leading the way, showing how DeFi can create dynamic in-game economies where players can earn, trade, and grow their wealth.

Moreover, the integration of DeFi with traditional finance is also on the horizon. More and more financial institutions are exploring DeFi and blockchain technology, considering how they can leverage it to improve their services. This could lead to the creation of hybrid models that combine the best of both worlds, offering the efficiency, transparency, and accessibility of DeFi with the stability and trust of traditional finance.

However, it’s not just about the technology. The future of DeFi also lies in the hands of the community. The open-source nature of DeFi projects means that anyone can contribute to the development and improvement of the protocols. This community-driven approach fosters innovation and ensures that DeFi remains a democratic and inclusive financial system.

DeFi is not just a trend or a buzzword; it’s a revolution that’s set to redefine the financial world. It’s creating a more open, transparent, and equitable financial system that has the potential to benefit everyone, not just the privileged few.

DeFi Is Here To Stay

DeFi is a powerful force that’s set to revolutionize the financial world. It’s breaking down barriers, democratizing access to financial services, and creating new opportunities for individuals and businesses alike. With its potential to transform the gaming industry and reshape the global financial landscape, DeFi is a trend that’s here to stay. As we move forward, it will be fascinating to see how this technology continues to evolve and shape our world.